Some Chinese companies now racing to make generic versions of Novo Nordisk’s Wegovy also supplied ingredients for more than a billion makeshift doses of weight-loss drugs sold online in the U.S. over the past two years, according to three sources and a Reuters review of shipping and public records.

Cheap copies of Wegovy and Eli Lilly’s Zepbound are on the retreat in the U.S. as regulators restrict their sale, slowing shipments from Chinese suppliers of the raw ingredients that allowed for explosive growth of the medicines.

Robert Califf, who had two stints leading the U.S. Food and Drug Administration, said never before had a new drug become so wildly popular that the manufacturer simply couldn’t keep up.

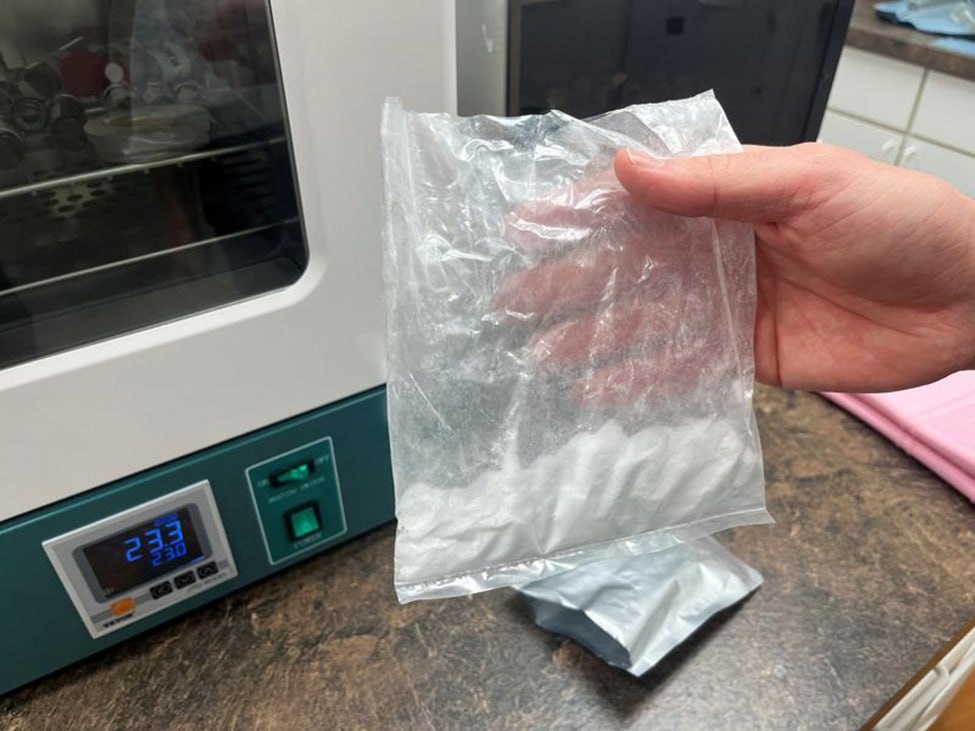

The shortage opened the door for compounding pharmacies, turbocharged by telehealth firms that flourished during the COVID pandemic, to supply cheap copies to a huge market chasing the promised weight loss.

The pivot to FDA-approved generics as patents expire in various countries follows a year of soaring demand for the branded drugs, which have been shown to help people shed as much as 20% of their weight.

At least eight Chinese companies, including publicly traded Jiangsu Sinopep-Allsino Biopharmaceutical and Hybio Pharmaceutical, helped flood the U.S. with raw semaglutide and tirzepatide, the main ingredients in Wegovy and Zepbound, respectively, sources told Reuters. A Reuters analysis of U.S. FDA shipping records backs that up.

Hybio and Sinopep are working to launch their own generic semaglutides, according to one of the sources with knowledge of the efforts and previous Reuters reporting. The source also said Nanjing Hanxin Pharmaceutical and Fujian Genohope Biotech, two of the companies that had supplied compounders, may launch as well.

None of the companies responded to requests for comment.

U.S. law now restricts compounding pharmacies to producing personalized doses for patients who need them, or formulations not offered by the branded medicines.

The source said that for one Chinese manufacturer, supplying ingredients for compounded weight-loss drugs had been its biggest business. The manufacturer is now targeting markets where Novo’s main semaglutide patent is expiring next year, such as Canada and Brazil, to sell the ingredient to generic drugmakers, he said.

He said he knew of at least five other Chinese companies known to supply compounding pharmacies that were similarly refocusing on supplying semaglutide for generics.

The switch is unlikely to produce similar explosive growth. Manufacturing semaglutide to its final, injectable form is complex, said a lawyer for a generic drugmaker who asked for anonymity because he was not authorized to discuss the topic.

Companies seeking to sell generics also may strike deals with branded companies that delay their market entry.